Marketing and sales go together like peanut butter and jelly. You need both, but because they are both responsible for sales there is often a tension between the two — one gets the blame or glory (depending on the situation).

The balance has shifted

The reality is that the internet has been changing the game. How people make purchasing decisions has radically shifted as people now want information and are more adverse than ever to traditional sales.

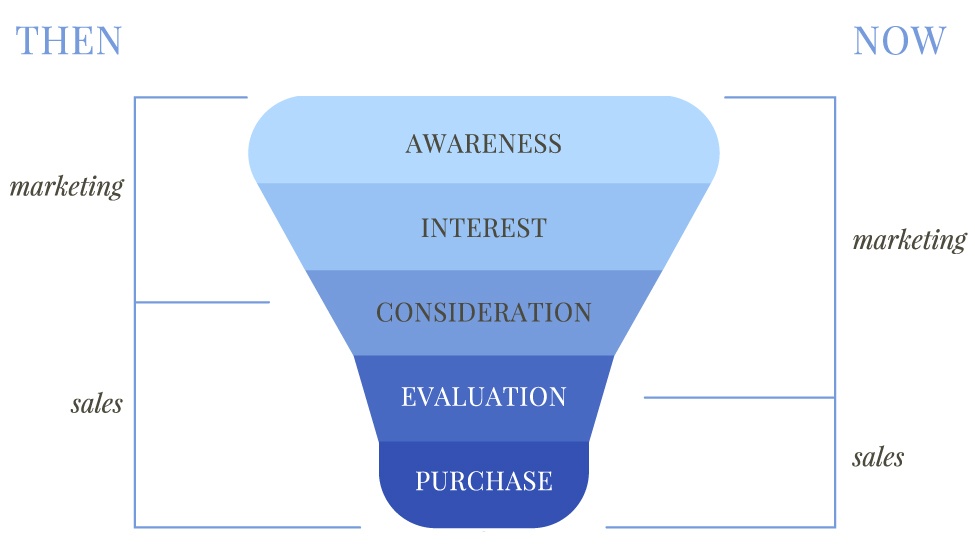

As you can see above, marketing used to play a smaller role. ‘Awareness’ and ‘interest’ were the primary role of marketing, maybe a little ‘consideration’. Marketing used to more clearly serve sales.

Now sales plays a much smaller role. In fact, I think this chart is a bit generous as making a decision before they call and are only looking for confirmation that they are making the right choice.

This dramatic shift in sales and marketing has allowed a different methodology of marketing to flourish

This methodology is called inbound marketing. I don’t want to say it is new because inbound marketing is the next generation of information marketing which has been around for a long time — think late night infomercials or the Home Shopping Network. But the internet has made it easy and cost efficient – and a bit more respectable I might add.

It is not either/or

Inbound marketing is often pitted against Outbound marketing (traditional interruption marketing). The boundaries between Inbound and Outbound are a bit artificial. The reality is that they work together — and Outbound (interruption) marketing is most effective when it is supporting an Inbound marketing strategy.

The Inbound advantage lies in aligning with people’s buying behavior (looking for information). It is measurable so you can learn and incrementally improve what you are doing – Inbound marketing makes marketing more data driven. While there will always be room for instinct and creativity, Inbound methodology provides the path to track that ‘X’ amount of money will generate ‘X’ amount of sales.

Inbound also more easily integrates with the sales process. When more and more sales are being made electronically this integration directly impacts sales.

The sooner and more in-depth one engages someone electronically, the more likely it is that they will complete the sale. At the least, Inbound is taking prospects on a journey with the end of the journey being a purchase decision.

Is Inbound marketing right for every financial planning firm?

I would not be a good marketer if I suggested that the same advice will work for everyone. I think the overarching theme of how people’s buying habits have changed needs to be accounted for in every financial planning firm, but how to utilize Inbound or Outbound marketing depends on a thoughtful examination of all the ways you communicate and what you are trying to promote.

We all know websites are the center of an organizations brand, but what does it really take to have a great website that drives visitors, leads and revenue? Download our free guide 25 Website Must-Haves for Driving Traffic, Leads & Sales.